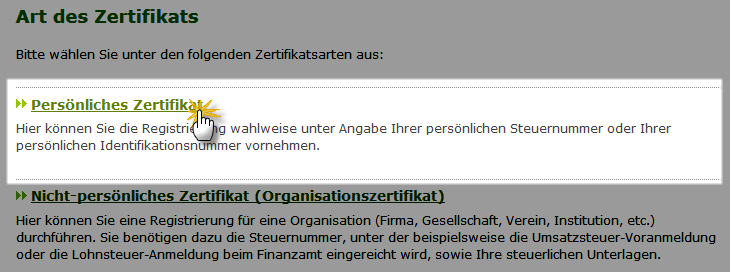

You also pay your income tax and value-added tax to your local Finanzamt office. You have to do this before you apply for the freelancer residence permit and before you are allowed to start working. When starting out as a freelancer, you have to go to your nearest Finanzamt office to declare your business or freelance activity and get your freelance tax number ( Steuernummer). There are over 600 Finanzamt offices across Germany. The Finanzamt is the German Tax Office responsible for tax collection, tax returns, and business registration on a local level. You submit your VAT returns digitally, through Finanzamt’s ELSTER tax portal.Įxemptions from VAT: If you make less than €22,000 in your first year and less than €50,000 in the second year, you are considered a “small business” ( Kleinunternehmer) and are not required to charge VAT to your clients. You have to submit your VAT return every month or quarter, depending on instructions from your local tax office. This process is called Umsatzsteuervoranmeldung (Advance VAT return). Everyone who offers goods and services must charge VAT to their clients and then transfer this sum to the Finanzamt, including freelancers. In addition to income tax, freelancers in Germany also have to pay value-added tax (VAT), known as Umsatzsteuer in German. VAT in Germany for Self-Employed People and Freelancers In the following years, the prepayments are calculated on your earnings from the previous year. The Finanzamt will use this to calculate the amount of tax you have to pay in your quarterly pre-payments. When you register your business at the Finanzamt, you have to give an estimate of how much you think you will earn. How to know how much to pay in tax pre-payments? Health Insurance for Refugees/Asylum Seekers.Health Insurance for Guest Scientists & Researchers.

Health Insurance for International Students.Travel Insurance for Visitors & Tourists.Family Reunion Visa to Join a Relative or Partner.Visa for Spouse / Relatives of EU / German Nationals.Visa for Cultural, Film Crew, Sports, and Religious Event Purpose.Visa for the Recognition of Professional Qualifications.

0 kommentar(er)

0 kommentar(er)