Cash Receipts from Fees and Commissions.Cash Receipts from Deposits by Banks and Customers.Cash Payments for Deposits by Banks and Customers.Cash from Discontinued Operating Activities.Cash From Discontinued Investing Activities.Short-Term Debt & Capital Lease Obligation.

Other Liabilities for Insurance Companies. Long-Term Debt & Capital Lease Obligation. Inventories, Raw Materials & Components. Cash, Cash Equivalents, Marketable Securities. Accumulated other comprehensive income (loss). Accounts Payable & Accrued Expense for Financial Companies. Depreciation, Depletion and Amortization. Margin of Safety % (DCF Dividends Based). Margin of Safety % (DCF Earnings Based).

Other Liabilities for Insurance Companies. Long-Term Debt & Capital Lease Obligation. Inventories, Raw Materials & Components. Cash, Cash Equivalents, Marketable Securities. Accumulated other comprehensive income (loss). Accounts Payable & Accrued Expense for Financial Companies. Depreciation, Depletion and Amortization. Margin of Safety % (DCF Dividends Based). Margin of Safety % (DCF Earnings Based).  Float Percentage Of Total Shares Outstanding. MACOM Technology Solutions Holdings, Inc.

Float Percentage Of Total Shares Outstanding. MACOM Technology Solutions Holdings, Inc.

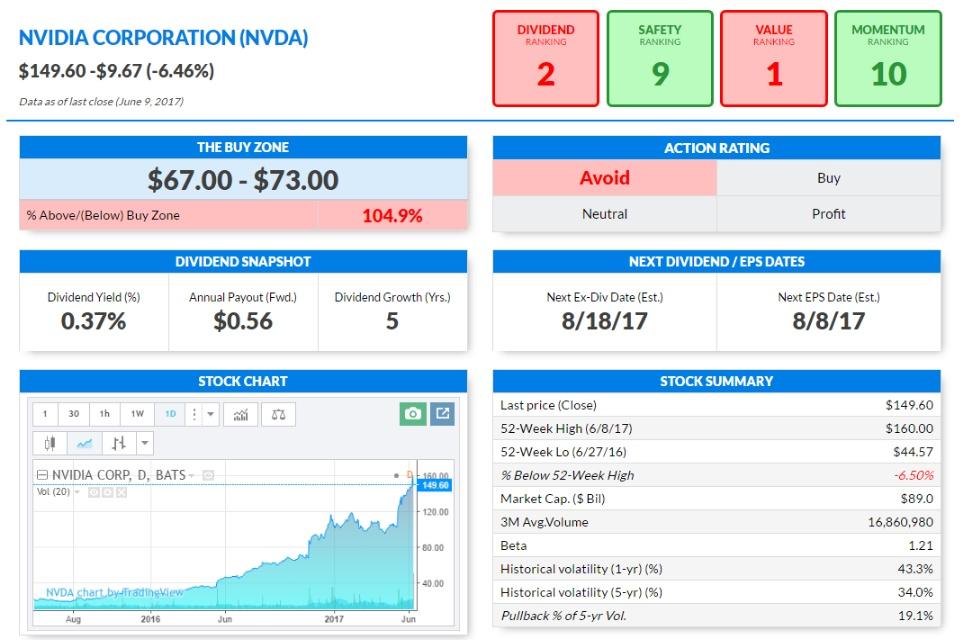

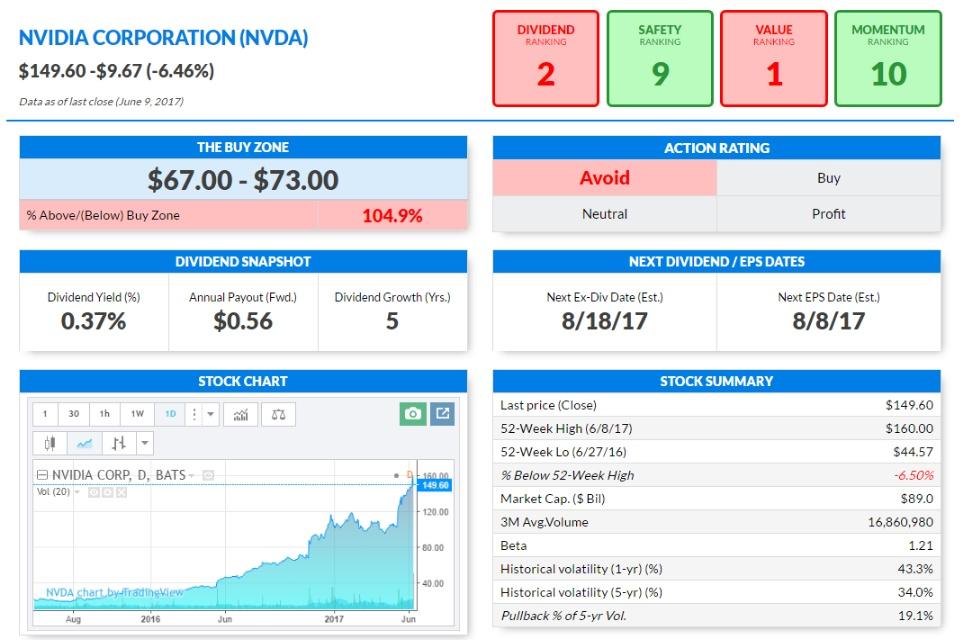

American Depositary Shares, each representing one Ordinary Share Siliconware Precision Industries Company, Ltd. its peers in the Semiconductor & Wireless Chip category.ĪU Optronics Corp American Depositary Shares NVDA's dividend yield currently ranks #47 of 127 vs.

NVDA's market cap of approximately $707 billion makes it a mega-sized market cap company out of dividend issuers in this group, the investment opportunity based on the difference between its current share price and its forecasted DDM value is greater than only 0% of them. Beta, a measure of volatility relative to the stock market overall, is lower for NVDA than it is for only 0% of other equities in the Technology sector that also issue dividends. NVDA's market cap is about 707 billion US dollars - its dividend yield of 0.06 is greater than only 0% of its fellow stocks in the mega market cap class. Digging deeper, the aspects of Nvidia Corp's dividend discount model that we found most interesting were: As for NVDA, the DDM model, as implemented by StockNews, implies a negative return of 99.57% relative to its current price. NVDA Price Forecast Based on Dividend Discount Model Current Priceįor dividend yielding stocks, the Dividend Discount Model (DDM) is a common valuation tool it attempts to extrapolate a fair share price based primarily on the dividend the stock provides relative to a number of other quantiative aspects of its business.

0 kommentar(er)

0 kommentar(er)